The market is flooded with the Cybertruck arrival and there are many comments and opinions rising from all directions. However, the Financial Experts at Jefferies Phillipe Houchois have stirred discussions by suggesting that the electric pickup might not be the immediate game-changer for Tesla’s financials. Despite the boldness of his statement, Houchois emphasizes broader concerns about Tesla’s near-term challenges and the need for strategic refocus.

Table of Contents

Financial Implications of Cybertruck’s Debut for Tesla

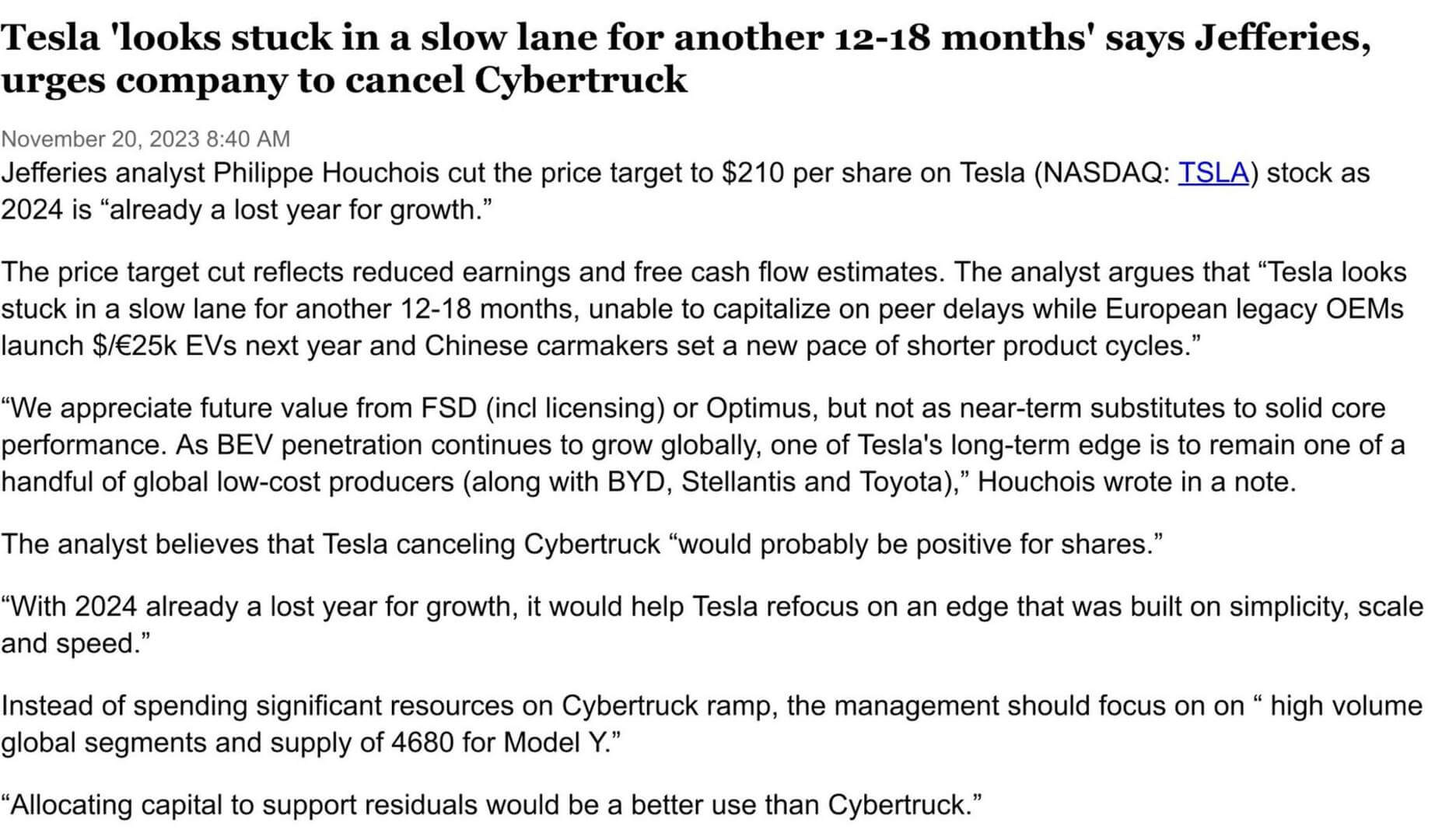

Houchois has cut Tesla’s price target to $210 per share, highlighting reduced earnings and free cash flow estimates. He argues that the Cybertruck is set for delivery in two days, but it could hinder Tesla’s short-term financial prospects. Now we can see a divide in the market among the Pro-Teslalites and Anti-Teslalites. Now the question is why the analyst is against the idea of Cybertruck?

The analyst perceives Tesla as being stuck in a “slow lane” for the next 12-18 months, unable to capitalize on delays by peer companies. He suggests that focusing on the Cybertruck production ramp might divert resources that could be better used in high-volume global segments and supply the 4680 cells for Model Y.

A Bloomberg survey indicates that among Tesla owners looking for a new vehicle, 37% are considering the Cybertruck.

Pricing and Market Appeal of Tesla Cybertruck

Highlighting the challenging landscape, Houchois notes the impact of higher rates on all automakers and suggests that a Cybertruck cancellation could mitigate some negative effects on affordability, residuals, and capital allocation. Tesla appears to face a slowdown in its growth trajectory for the next 12-18 months, limiting its ability to take advantage of delays by peer companies.

This comes at a time when European legacy Original Equipment Manufacturers (OEMs) are gearing up to launch EVs priced at around $/€25,000 next year, and Chinese automakers are setting a new standard with shorter product cycles. Philippe Houchois highlighted these challenges in a recent note, underscoring the competitive dynamics shaping the electric vehicle market.

Tesla has been tight-lipped about Cybertruck details, leading to anxiety among reservation holders. With inflation pushing pickup prices up by 28%, there are concerns about a potential repricing that could put the Cybertruck out of reach for many.

The reason as to why Tesla is facing bulk cancellations on the Cybertruck is because of the following reasons:

- Misaligned doors and uneven surfaces.

- The front trunk, reveals partial lining and missing trims.

- The Cybertruck lacks real-world factors like thermal expansion and contraction as pointed out by the Adrain Clarke.

- Cybertruck’s flat panels may not play well with the crash and pedestrian impact regulations.

- Tailgate – it stands at armpit height for the average person this would be difficult to use when loading and unloading.

Another factor to consider is that Tesla’s CEO Elon Musk has hinted that the company might change the face of the vehicle and address the potential errors in the precision and design of the truck.

Tesla Cybertruck Pricing Strategy

If Tesla aims to compete with the F-150 Lightning, the dual-motor Cybertruck might hit around $60,000. This becomes a critical threshold, defining whether it’s a utility workhorse or a luxury toy. Another factor that will reflect in the prices of Cybertruck is the battery range.

General Motors’ Silverado EV, boasting a 450-mile range, raises the bar. Tesla needs to deliver not just on the range but the cost per mile, a crucial metric for widespread market appeal.

The exact cost of owning a Cybertruck remains shrouded in uncertainty. Back in 2019, Tesla initially quoted a $40,000 price tag for the Cybertruck. However, Elon Musk has hinted that this figure is subject to change, leaving potential buyers in suspense.

For example, Tesla models kick off around $40,000 for the base model of the Tesla Model 3, extending up to a hefty $108,490 for the Plaid variant of the Tesla Model X. Anticipation surrounds the Tesla Roadster, projected to claim the title of the brand’s most expensive model with an estimated starting price of around $200,000 once it hits production.

The original $40,000 estimate has become a moving target, reflecting Tesla’s flexible approach to market dynamics and consumer expectations.

Houchois on Tesla Cybertruck Cancellation

The cancellation, according to Houchois, could positively impact Tesla shares by allowing the company to regain its edge built on simplicity, scale, and speed. He argues that allocating capital to support residuals would be a more prudent move than investing further in the Cybertruck.

The prices of Cybertruck plummeted even when Elon Musk shared in a secret document that “We dug our graves with the Cybertruck” on the day of Tesla’s third income quarter earnings.

While expressing short-term concerns, the analyst also sees positive factors for Tesla, including potential Model 3 refresh hikes, easing China pressure, new incentives, and the critical variable of ramping up 4680 cells for 2024 margins.

Tesla Cybertruck Production Challenges

Elon Musk, the driving force behind Tesla, envisions a future where the Cybertruck becomes a common sight on roads. He anticipates a production target of around 250,000 Cybertrucks per year. However, Elon signaled a reality saying that achieving this production volume won’t be an immediate triumph. He tempers expectations, projecting that the ambitious goal might not be realized until 2025, acknowledging the intricate challenges associated with such a massive ramp-up.

Describing the upcoming production phase, Musk uses terms like “extremely difficult” to highlight the hurdles that lie ahead. He recognizes that breaking new ground and creating something groundbreaking like the Cybertruck comes with inherent challenges, mainly because there’s no blueprint to follow.

In Musk’s own words, “The ramp is going to be extremely difficult. There’s no way around that. If you want to do something radical and innovative and something’s really special like the Cybertruck, it is extremely difficult because there is nothing to copy.”

Cybertruck’s Impact on Tesla’s Portfolio and Vision

The journey began in 2017 with the launch of the Model 3, followed by the arrival of the Model Y in 2020. Investors initially fretted that the Y might overshadow the 3, but the plot took an unexpected turn. Contrary to fears, Tesla not only sustained Model 3 sales in the U.S. but also rolled out approximately 250,000 Model Y vehicles. The grand finale for Tesla in 2022 showcased a staggering 150% surge in U.S. sales compared to 2020, marking both the Y and 3 as undeniable crowd-pleasers.

Fast forward to the present, and investor attention has shifted from the triumphs of 2022 to the uncharted territories of 2023 and 2024. The global stage is set, with Wall Street casting its gaze on an estimated 476,000 Tesla units for the fourth quarter of 2023 and a further 487,000 anticipated in the opening quarter of 2024. As the curtain falls on 2023, the looming question is whether the Cybertruck, with its distinctive allure, will weave its magic and influence late-year sales.

When the Cybertruck made its debut in 2019, the initial investor discourse didn’t revolve around a potential halo effect. Instead, the focus was on unlocking a lucrative niche in the market. The backdrop featured automotive giants like Ford, General Motors, Dodge, and Toyota collectively selling around 1.6 million full-size pickup trucks in the U.S. during the first three quarters of 2023 – a substantial 14% of all light vehicle sales.

With a lineup comprising the Model 3, Model Y, and the unconventional Cybertruck, Tesla has broadened its automotive market footprint. However, a missing piece in the puzzle remains – a smaller EV that can go head-to-head with the more affordable Chinese counterparts. The landscape also reveals a scarcity of budget-friendly EV options for U.S. car buyers.

Conclusion

Traditional truck buyers have diverse needs, and a one-size-fits-most approach might not resonate. The Cybertruck must offer compelling functionality and overcome its polarizing design so that it is appealing to the audience at large or else it’ll be like the antique model that belongs to the museum.