Tesla has announced a significant update regarding the Federal EV tax credit for its Model 3 Rear-Wheel Drive (RWD) and Long Range models. Contrary to previous expectations, these models will no longer be eligible for any portion of the $7,500 Federal EV tax credit starting January 1, 2024. This update follows revised guidance from the IRS, marking a critical shift in the incentives available for Tesla buyers.

Tesla Model 3 Federal Tax Credit Update

Tesla had initially anticipated that the Federal EV tax credit for the Model 3 RWD and Long Range would be reduced to $3,750. However, the latest interpretation of the new Inflation Reduction Act (IRA) guidance indicates that the credit for these models will be completely phased out from the beginning of 2024.

Tesla urges customers interested in these models to take delivery by December 31, 2023, to avail of the full $7,500 tax credit. This announcement creates a sense of urgency for potential buyers, offering a narrow window to capitalize on the substantial savings before the credit expires.

Updated Website Language Reflects Changes

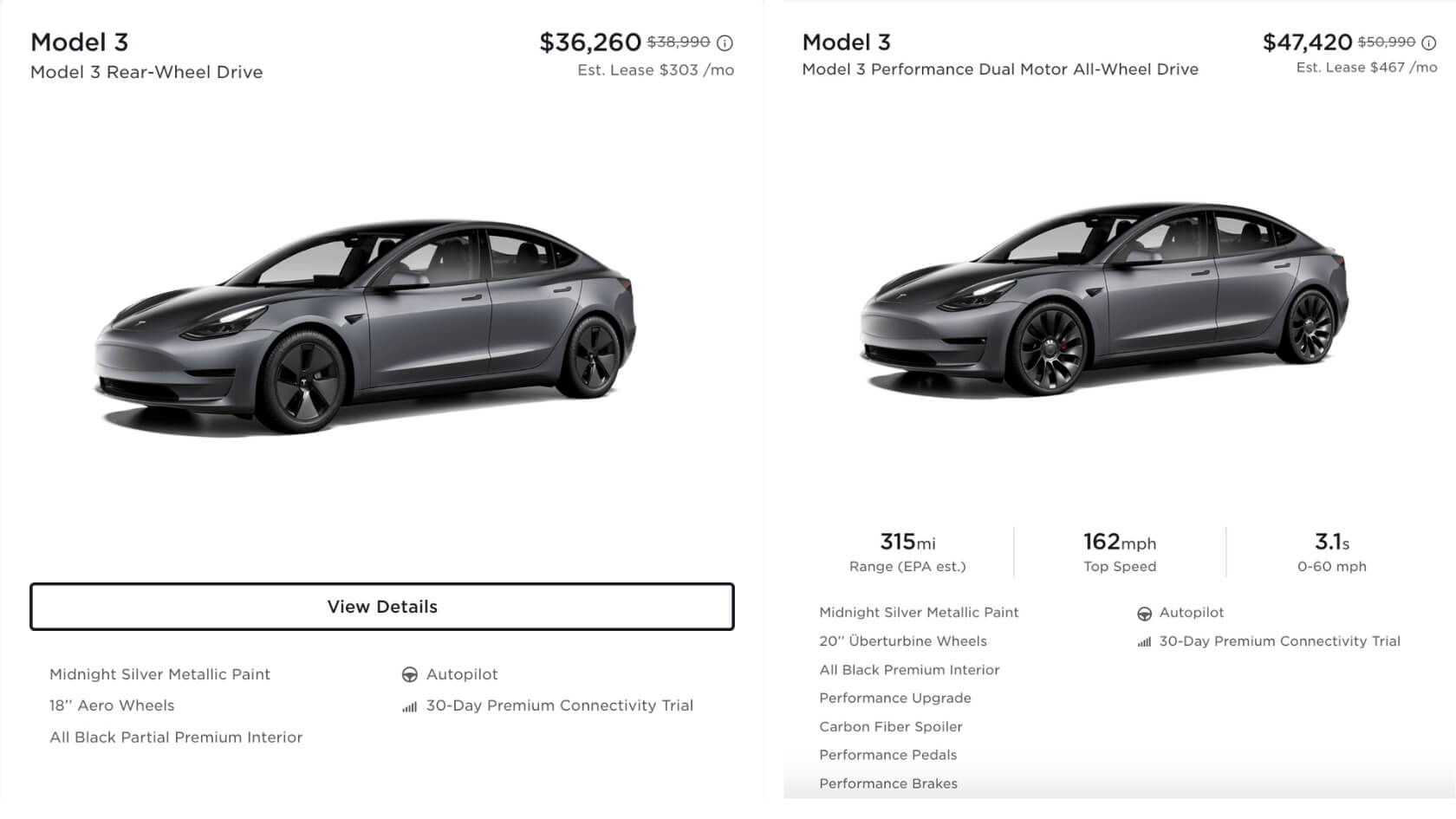

Tesla has promptly updated the language on their Model 3 configuration page to reflect this change. The new website statement reads: “Customers who take delivery of a qualified new Tesla and meet all federal requirements are eligible for a tax credit up to $7,500. Tax credit will end for Model 3 Rear-Wheel Drive and Model 3 Long Range on Dec 31 based on current view of new IRA guidance. Take delivery by Dec 31 for full tax credit. Only for eligible cash or loan purchases.”

Tesla Inventory Discounts

As Tesla prepares for the imminent phase-out of the $7,500 Federal EV tax credit for its Model 3 RWD and Long Range models, another significant factor comes into play – Tesla’s inventory discounts. These discounts, offered by Tesla, add an additional layer of appeal for potential buyers, especially in the context of the changing tax credit landscape.

Tesla’s inventory discounts, although not specified in exact figures, present an attractive proposition for buyers. These discounts are applied to Tesla vehicles available in inventory, potentially reducing the overall cost of purchase. In a market where electric vehicle prices can be a barrier to entry for many, such discounts can make a substantial difference, making Tesla vehicles more accessible to a broader audience.

Influence on Buyer Decisions

The timing of these inventory discounts is particularly crucial. With the Federal EV tax credit for the Model 3 RWD and Long Range set to disappear after December 31, 2023, prospective buyers are already feeling a sense of urgency. The addition of inventory discounts serves as a further incentive, possibly swaying those who are on the fence about making a purchase.

For many, the combination of a significant tax credit and additional discounts could be the deciding factor in choosing a Tesla. It represents a unique opportunity to obtain a high-quality electric vehicle at a more affordable price point. This is especially relevant for those who have been considering an EV but are concerned about the higher upfront costs compared to traditional gasoline vehicles.

Implications for Tesla Buyers and EV Market

From a business perspective, offering inventory discounts alongside the tax credit deadline is a strategic move by Tesla. It not only encourages immediate purchases but also helps Tesla clear out existing inventory, making room for newer models or variants. This strategy could lead to a noticeable boost in Tesla’s sales figures as the year-end deadline approaches.

This abrupt change in the EV tax credit eligibility could significantly impact consumer decisions, especially for those considering a Tesla purchase. The Model 3, known for its blend of performance, efficiency, and technology, has been a popular choice among EV enthusiasts. The full tax credit has been a key factor in making these models more accessible to a broader audience.

With the clock ticking towards the year-end deadline, prospective Tesla Model 3 RWD and Long Range buyers are now in a race against time to secure their vehicles with the full tax benefit. This development is expected to drive a surge in Tesla sales as customers rush to take advantage of the expiring credit.

Conclusion

The change in the Federal EV tax credit policy for Tesla’s Model 3 RWD and Long Range models marks a pivotal moment for both the company and its customers. It underscores the dynamic nature of the EV market and the importance of staying informed about policy changes that can significantly affect the cost and appeal of electric vehicles. As the deadline approaches, Tesla showrooms and online platforms are likely to witness a flurry of activity from buyers eager to secure their electric dream car with the best possible financial advantage.