Tesla has recently updated the wording regarding the federal tax credit for its Model 3 electric vehicles, changing from “may reduce” to “will reduce.” This change provides clarity and certainty for prospective buyers about the availability of the tax credit. It’s crucial to note that the amount of this federal tax credit is scheduled to decrease in 2024. This impending reduction means that while the tax credit will still be available, its financial benefit to purchasers of Tesla Model 3 vehicles will be less starting next year.

In addition to this significant federal tax credit update, Tesla has introduced attractive inventory discounts for the Model 3 in 2023. These discounts vary, offering substantial reductions on the purchase price of new Tesla Model 3 vehicles directly from the inventory. This pricing strategy is likely to appeal to a wider range of customers, making Tesla’s electric vehicles more accessible to a broader audience.

Federal Tax Credit Changes for 2024

Currently, new Tesla Model 3 vehicles are eligible for a federal tax credit, which offers a significant incentive for buyers. This credit stands at $7,500, directly reducing the tax liability of those who purchase a new Model 3. However, this benefit is scheduled for a reduction starting January 1, 2024. From this date, the tax credit for the Model 3 Rear-Wheel Drive and Model 3 Long Range will be halved to $3,750.

This upcoming change is crucial for potential Tesla buyers to consider. To take full advantage of the current, more substantial tax credit, buyers are encouraged to complete their purchases and take delivery of their vehicles before the end of 2023, specifically by December 31. Doing so ensures eligibility for the higher tax credit amount, offering significant savings on the purchase of a new Tesla Model 3. This window of opportunity is limited, making timely decision-making essential for those considering a Model 3 purchase.

Inventory Discount on Tesla Model 3

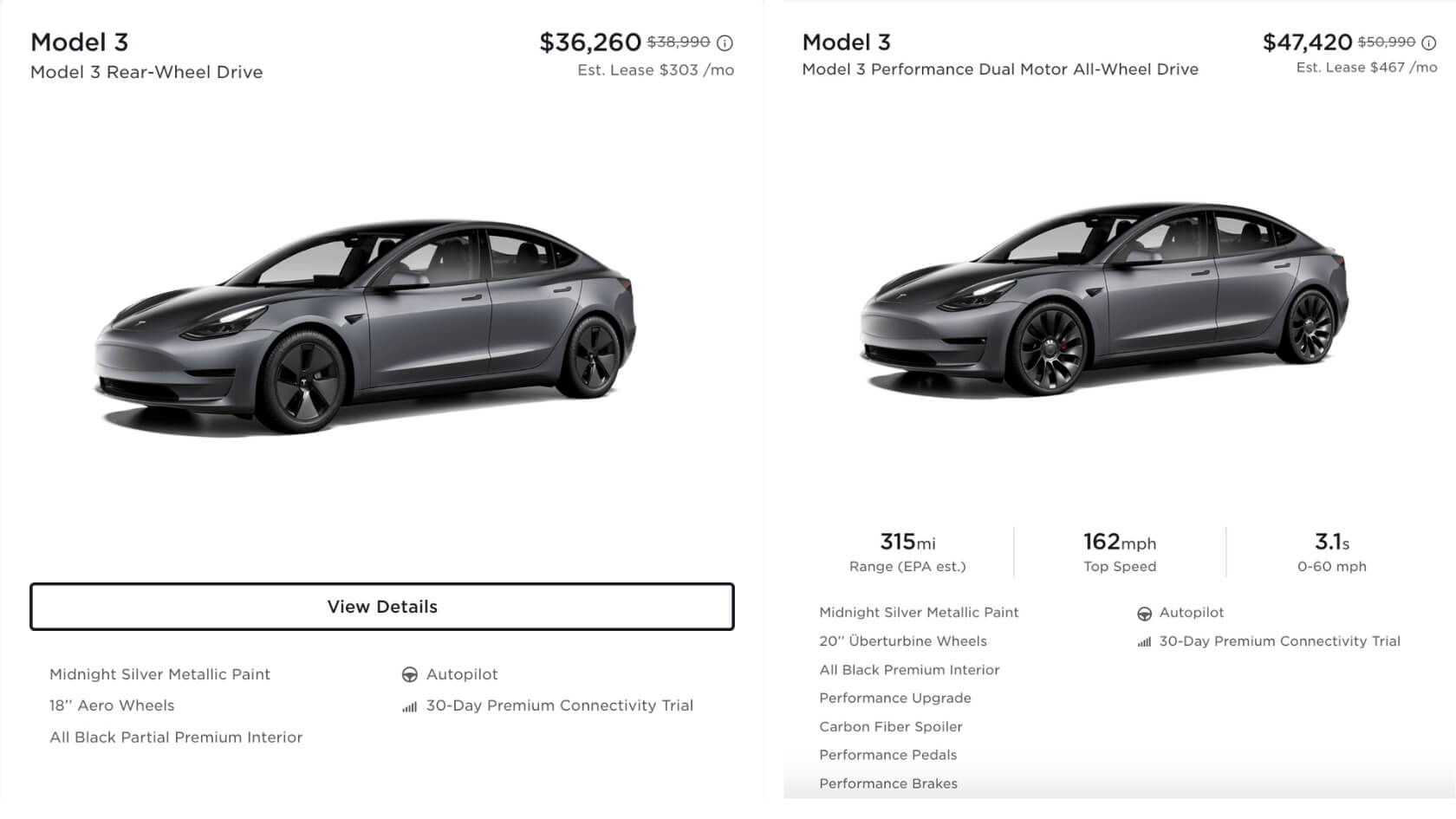

Tesla has introduced inventory discounts on its Model 3 vehicles, offering a notable reduction in prices for its new inventory cars. These discounts include a reduction of up to $2,730 on new inventory Model 3 vehicles in the US, effectively bringing the starting price down to $36,260 before any incentives. Additionally, specific Model 3 variants are seeing discounts of more than $3,000. For example, the performance has been offered at $47,420, which is $3,570 below the cost of a custom order.

These discounts significantly lower the initial cost barrier for purchasing a Tesla Model 3, making these electric vehicles more accessible to a wider range of customers. The reduction in starting prices varies across different Model 3 variants, reflecting Tesla’s strategy to enhance market appeal across its model range.

Impact of Inventory Discounts

The impact of these inventory discounts is amplified when combined with the federal tax credit. For instance, with the $7,500 federal tax credit, the effective cost of a Model 3 can be significantly reduced. Taking the discounted price of $28,760 for the new inventory Model 3, and applying the federal tax credit, brings the price down to an even more attractive point.

These combined savings illustrate the financial viability and appeal of owning a Tesla Model 3 in the current market. The reduction in prices due to inventory discounts, along with the sizable federal tax credit, presents a compelling value proposition for those considering an electric vehicle, particularly as we approach the end of 2023 when the full benefit of the current tax credit can still be realized.

Additional State Tax Credits

In addition to federal incentives, many states in the United States offer their own tax credits for electric vehicle purchases, which can further reduce the cost of buying a Tesla Model 3. These state tax credits vary significantly from one state to another, both in terms of the amount and the eligibility criteria.

For instance, some states provide a flat tax credit that can be applied directly to the purchase price of an EV, while others offer rebates or reduced vehicle registration fees. The value of these state tax credits can range from a few hundred to several thousand dollars, making a substantial difference in the overall cost of the vehicle.

These state-specific incentives, when combined with the federal tax credit and Tesla’s inventory discounts, can lead to a considerably lower purchase price for a Tesla Model 3. Buyers are encouraged to research the specific EV incentives available in their state to fully understand the potential savings. This understanding is crucial for making an informed decision about purchasing a Tesla Model 3, as the combined savings from federal and state incentives can significantly enhance the affordability of these electric vehicles.

Tesla Model 3 Pricing in 2023

As of 2023, the pricing for different Tesla Model 3 variants in the United States is as follows:

- Rear-Wheel Drive: Starts at $38,990.

- Long Range: Priced at $45,990.

- Performance Model: Available at $50,990.

When the federal tax credit and inventory discounts are applied, these prices can be significantly reduced. For instance, the Rear-Wheel Drive variant, initially priced at $38,990, can be reduced to $28,760 after applying the $7,500 federal tax credit and the typical inventory discount of $2,730. Similar reductions apply to the Long Range and Performance models, making these vehicles more affordable.

Conclusion

The combination of federal tax credits, state tax credits, and inventory discounts significantly enhances the affordability of the Tesla Model 3 in 2023. These incentives collectively reduce the overall cost of purchasing a Model 3, making it an attractive option for a broader range of buyers.

As the federal tax credit is set to decrease in 2024, potential buyers should consider making their purchase before the end of 2023 to maximize these benefits. Additionally, investigating state-specific tax credits can lead to further savings. The current incentives present a compelling opportunity for those considering an electric vehicle, particularly the Tesla Model 3, known for its performance, efficiency, and technological advancements.