It’s confirmed that several Tesla models meet the government-established criteria for the full $7,500 Federal EV tax credit in 2024. This eligibility, which includes the Model 3 Performance, Model Y RWD, Model Y Long Range, Model Y Performance, and Model X Long Range, is a significant milestone for Tesla and the EV sector as a whole.

This development is crucial because it signifies that these Tesla models comply with the stringent requirements set by the Inflation Reduction Act (IRA). The IRA emphasizes the importance of domestic production and sustainable supply chains in the EV industry. Tesla’s ability to meet these criteria demonstrates the company’s commitment to aligning with government standards that promote environmentally friendly and sustainable transportation options.

For consumers, this means enhanced accessibility to some of Tesla’s most advanced and desirable electric vehicles, thanks to the financial incentives provided by the tax credit. It’s a move that could potentially increase the appeal and sales of these models, reflecting a growing demand for sustainable mobility solutions.

Tesla Models Eligibility

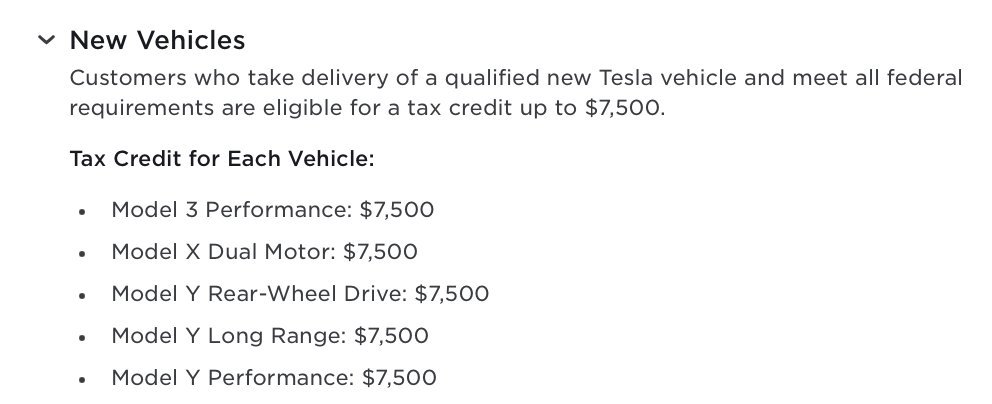

Tesla has recently updated the list of models eligible for the full $7,500 Federal EV tax credit, a move that has been eagerly anticipated by both the automotive industry and potential EV buyers. The eligible models now include:

- Model 3 Performance

- Model Y Rear-Wheel Drive (RWD)

- Model Y Long Range

- Model Y Performance

- Model X Long Range

It’s important to note, however, that not all Tesla models have retained this eligibility. Specifically, the Model 3 Rear-Wheel Drive (RWD) and Long Range (LR) models are now excluded from receiving the full tax credit. This distinction is crucial for potential buyers to consider when making their purchasing decisions.

The Model 3 Performance, now priced at $43,490 and still qualifying for the rebate, unexpectedly becomes a more cost-effective option than the Model 3 Long Range, which is priced at $45,990 without the rebate eligibility.

Federal Tax Credit Information

For each of the eligible models, the Federal EV tax credit offers a substantial financial incentive. Here’s a breakdown of the tax credit available for each model:

- Model 3 Performance: Eligible for a $7,500 tax credit.

- Model Y RWD: Also qualifies for the full $7,500 credit.

- Model Y Long Range: Buyers can receive a $7,500 tax credit.

- Model Y Performance: Eligible for the $7,500 credit.

- Model X Long Range: Qualifies for the full $7,500 tax credit.

This tax credit significantly reduces the effective cost of these vehicles, making them more financially accessible to a wider range of consumers and enhancing the appeal of opting for an electric vehicle.

IRA Requirements for EV Tax Credit

The eligibility for the Federal EV tax credit is governed by specific criteria outlined in the Inflation Reduction Act (IRA). These requirements are designed to encourage the production and use of electric vehicles that are environmentally friendly and support domestic industries.

If any EV in the US is not eligible for the EV credit, it's because it didn't meet the requirements below. pic.twitter.com/t8v8i4gAG2

— Sawyer Merritt (@SawyerMerritt) January 1, 2024

The key IRA requirements for EV tax credit eligibility include:

- Battery Component Sourcing: Starting in 2024, vehicles must not source battery components from foreign entities of concern. This requirement continues into 2025.

- Critical Mineral Sourcing: For 2024, vehicles are still compliant even if critical minerals are sourced from foreign entities of concern. However, by 2025, this will no longer be compliant.

- Battery Assembly in North America: At least 60% of the battery components must be assembled in North America in both 2024 and 2025.

- Sourcing of Critical Minerals: In 2024, at least 50% of critical minerals must be sourced from North America or a U.S. free trade partner. This requirement increases to 60% in 2025.

Tesla’s compliance with these IRA requirements not only makes its vehicles eligible for the tax credit but also aligns with broader goals of promoting sustainable practices and supporting domestic production in the EV industry. For consumers, this compliance ensures that their choice of a Tesla vehicle is not only financially savvy but also environmentally and ethically sound.

Impact on Tesla’s Lineup

Tesla’s announcement has broader implications for the EV market and sustainable transportation as a whole. By aligning its models with the Federal EV tax credit requirements, Tesla sets a benchmark for other manufacturers, potentially accelerating the industry-wide shift towards more sustainable and domestically supported EV production.

Looking ahead, Tesla’s role in the evolving EV landscape appears to be increasingly influential. As the company continues to innovate and expand its lineup, it is likely to drive further advancements in EV technology, battery efficiency, and sustainable manufacturing practices. This leadership could spur competition and innovation among other automakers, leading to a more dynamic and diverse EV market.

Tesla’s compliance with the IRA requirements also reflects a growing trend towards more environmentally responsible and ethically sourced manufacturing processes. This shift is expected to resonate with consumers who are increasingly conscious of the environmental impact of their purchases, further driving the demand for EVs.

Conclusion

The recent announcement by Tesla regarding the eligibility of several of its models for the full $7,500 Federal EV tax credit marks a significant milestone in the company’s journey and the broader EV industry. This development not only enhances the appeal of Tesla’s EV lineup but also aligns with the company’s commitment to sustainability and innovation.

By meeting the stringent requirements of the Inflation Reduction Act, Tesla not only secures financial incentives for its customers but also reinforces its leadership role in the transition towards cleaner, more sustainable mobility. This alignment with federal incentives and sustainable practices is a testament to Tesla’s adaptability and foresight in an ever-evolving market.