GEICO, one of the largest insurance providers in the U.S., may have quietly put the futuristic truck on its “do not insure” list. According to a Reddit user who was to renew the Cybertruck insurance, his insurer denied covering his Tesla Cybertruck.

GEICO informed him that it would not be offering renewal when its current six-month policy expires. If true, this means the Cybertruck now finds itself alongside other high-risk, high-end vehicles like Lamborghinis and Bugattis, which GEICO also deems too risky to cover.

Here’s the whole story!

Cybertruck Too Risky To Insure

Robert Stevenson, a Cybertruck owner, recently shared on Reddit that Geico had canceled the insurance for his few months old vehicle. According to Stevenson, Geico stated that the Cybertruck “doesn’t meet our underwriting guidelines,” leading to its removal from the policy.

Other owners on the Cybertruck Owners Club have also reported similar experiences with Geico denying coverage for the truck.

Hey @elonmusk, hit a snag with my #Cybertruck—the 2nd delivered in NYC! Love the car. Just months after getting it, @GEICO dropped my coverage, saying they won't insure CTs anymore. Struggling to find an insurer after 5+ brokers turned me down. Can't drive it and also can't sell…

— Pranav (@vaneckpk) August 2, 2024

GEICO is one of the biggest vehicle insurance companies in the United States and it has made the shocking decision to stop covering Tesla Cybertrucks. The company is reportedly canceling existing policies for the Tesla electric truck, stating that the Cybertruck “doesn’t meet our underwriting guidelines.”

What’s Driving GEICO’s Decision?

Other users have reported that while the insurance giant has agreed to insure their Cybertrucks, they’re doing so at a premium—sometimes a very steep one.

One user saw their premium increase by $200 per month upon renewal, while another was quoted $3,000 for just six months of coverage. For context, the average monthly car insurance premium in the U.S. is typically under $200, making these Cybertruck figures eye-popping.

Geico Reportedly Drops Coverage for Tesla’s Cybertruck For Some Consumers

And it’s not just an isolated case as several other Tesla owners have shared similar experiences as well. Some even reported monthly insurance costs increasing from as low as $200 to a staggering $1,000 more.

Geico quoted insurance for $1700, that’s over $1000 more on a 6 month premium than my CRV!!

byu/Dr0gbasH3AD inTeslaModelY

So, what’s going on?

While Anderson, the Reddit user with eight vehicles under his GEICO policy, noted that only the Cybertruck’s coverage was being terminated, his other cars were still insured. He has an impeccable driving record, leaving little doubt that the issue lies with the Cybertruck itself, not with the driver.

The real reason behind GEICO’s reluctance to insure the Cybertruck might be tied to the vehicle’s numerous problems and its expensive, time-consuming repairs. But, we cannot say anything for sure as there is no official statement from the insurance company.

Never Ending Issues With Cybertruck

Since its release, Tesla’s Cybertruck has made headlines for all the wrong reasons, and it’s not uncommon to hear about Cybertrucks breaking down in the middle of the road or becoming “bricked” without warning. In fact, within the span of one week, there were reports of three separate Cybertruck breakdowns.

Tesla Recalls All 3,878 Cybertrucks to Address High-Risk Trapped Accelerator Pedal Issue

One owner was locked out of his truck for three weeks after it bricked for the second time, while another driver, still a fan of the truck, recounted eight service visits over five months, all without resolving his vehicle’s issues. One unfortunate owner experienced multiple issues with his Cybertruck, to the point where Tesla engineers had to drill open the locked Cybertruck.

Cybertruck “frunk” Malfunction: Customer Says Tesla Drilled New Holes to Open It

Tesla service technicians are reportedly waiting for upper management to issue a recall (done quite a few times already) for the Cybertruck and possibly even a refresh to address these mounting problems.

Cybertruck’s Repairs Cost & Time

While Tesla’s warranty may cover many of these failures, the Cybertruck presents another significant issue for insurance companies: the cost and time involved in repairs. A simple fender bender, for example, ended up costing one owner over $13,000 to repair.

In other cases, repair costs even have exceeded $20,000 for relatively minor accidents. These sky-high costs, combined with the vehicle’s long wait times for repairs, are likely frustrating for insurers like GEICO, who might be hesitant to take on the financial risk.

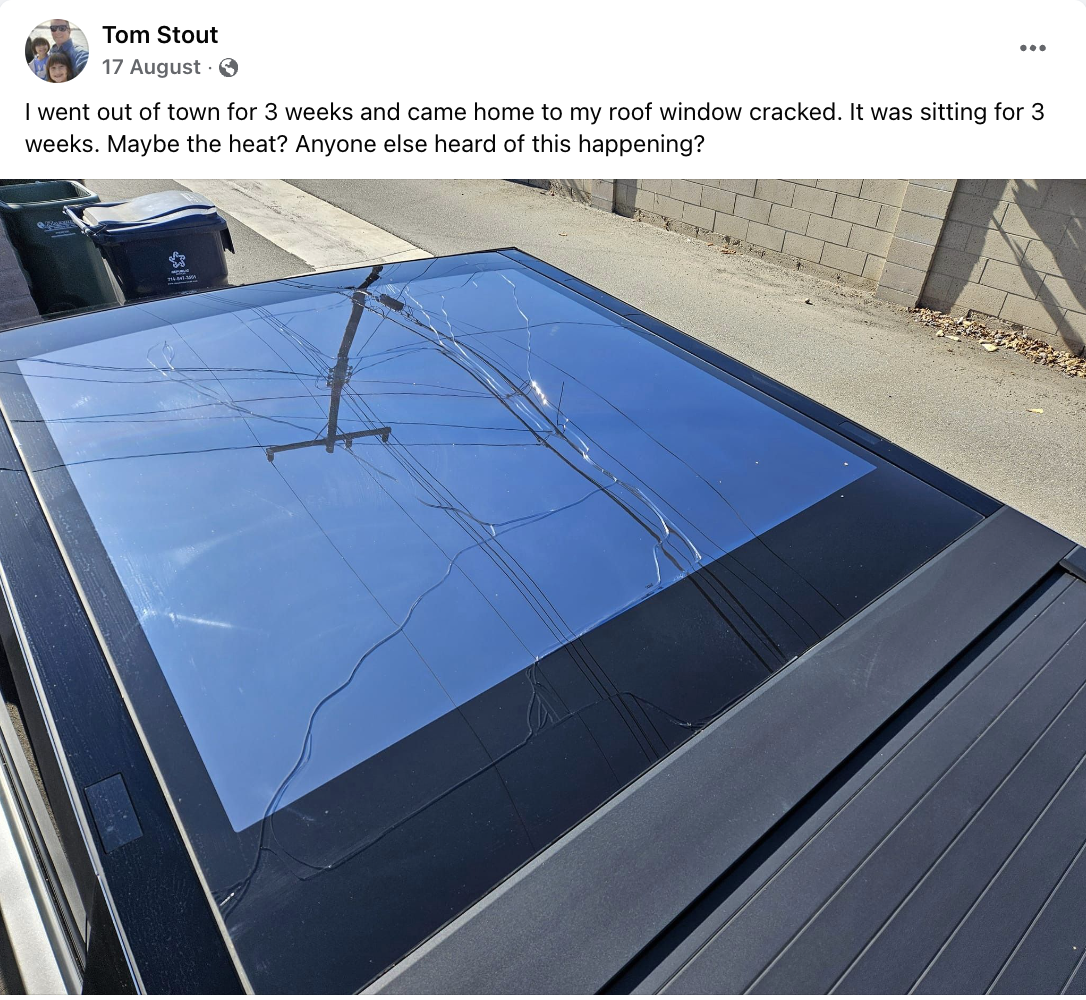

And then there’s the glass. Several Cybertruck owners have reported that the “transparent metal” glass has shattered spontaneously after being left in the sun too long. Others have shared stories of their windshields cracking from a light tap with a wedding ring can you imagine? The list is bizarrely endless.

What Is Happening?

At the end of the day, we don’t have any official confirmation from GEICO about why they’re refusing to cover the Cybertruck? or why they are charging outrageous premiums for it. Between the vehicle’s numerous technical issues, its massive repair costs, and the liability concerns, it’s easy to see why the Cybertruck might not be worth the risk for some insurers.

And let’s not forget the long-standing animosity between Tesla’s Elon Musk and Warren Buffett, whose Berkshire Hathaway owns GEICO. The two have butted heads in the past, especially over Tesla’s solar panel deployments in Nevada, and this might add another layer to the story.

However, the insurance company declined the claims of not providing insurance coverage and is saying that they’re very well offering insurance to Tesla Cybertruck nationwide.

Bottomline

The Cybertruck may not deliver exactly what was promised in 2019, but it still retains its standout feature: the sturdy stainless steel body panels. While this material is highly damage-resistant, even touted to stop bullets, repairs could be complex and costly if damaged, potentially becoming the truck’s weak point.

It’s possible that GEICO simply doesn’t want to deal with the liability of insuring a vehicle that’s both expensive to repair and poses a risk to others on the road.

For Tesla and its customers, though, the challenge remains: Whether or not to trust the Cybertruck wave and how to get their Tesla electric truck insured!