Tesla has just started to offer $0 down leases on certified pre-owned (CPO) vehicles, marking the company’s first entrance into the market segment, which is relatively uncommon in the automotive industry. The relocation is due to the EV manufacturer’s rush to clear the federal tax credit deadlines for new and used electric vehicles, which expire on September 30.

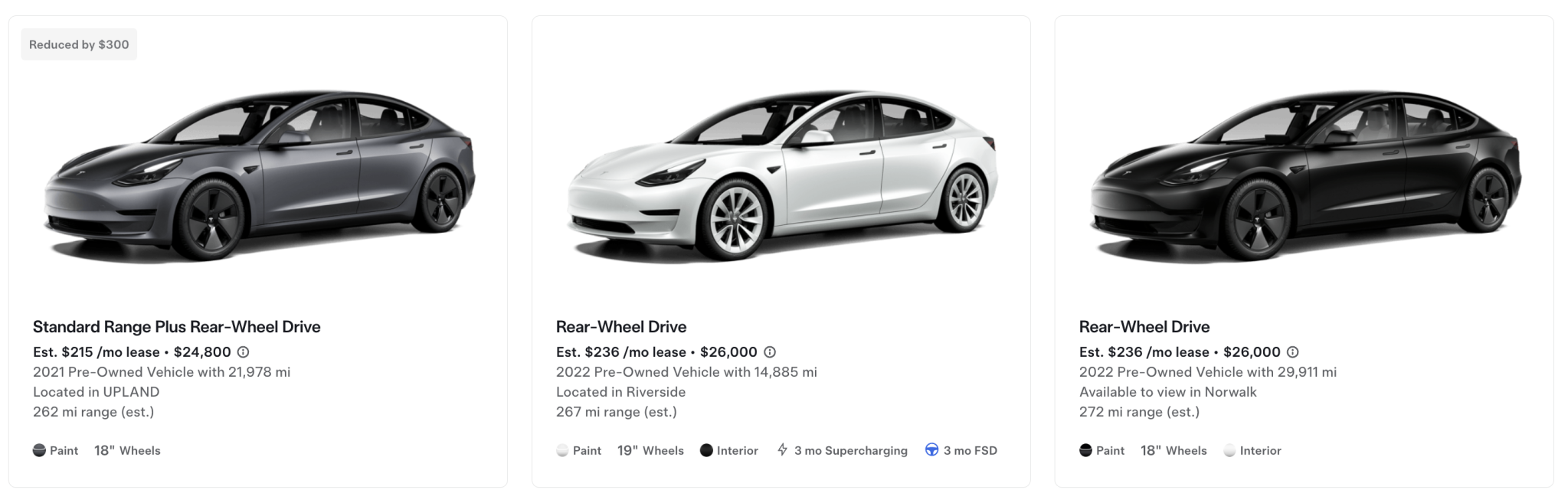

In California and Texas, Tesla is now offering CPO versions of the Model 3 and Model Y with monthly lease payments as low as $215 per month with a 24-month lease term at 10,000 miles per year. The company also offers a 12-month lease where the mileage allowance is up to 15000 miles per annum.

The customer is required to pay a standard fee of $695 together with the initial month’s rent. To buyers who have been on the fence, making the transition to a new Tesla, the program offers the least expensive gateway yet.

Why Used Car Leasing is Unusual

Leasing has been the customary way of selling new cars, and it enables automakers to shift cars quickly, while customers receive smaller monthly instalments. Nonetheless, the leasing of used vehicles is uncommon. The majority of auto companies and sellers concentrate on the retail selling of used cars, though it is easier to factor in resale quantities and to finance.

The move by Tesla to enter this market shows a shifting strategy and a desperate need in order to drive demand. There are tens of thousands of cars in inventory, and the company is trying to devise new methods to woo buyers who might not have been able to afford new cars or were not willing to take long-term financing.

The Tax Credit Clock is Ticking

This action now takes place at a critical time. The tax credits on both used and new EVs of up to $7,500 each on new cars and 4,000 on the used cars will run out towards the end of the quarter. Automakers are actively trying to move sales as quickly as possible before that date, including Tesla.

This expiration date is a bit of a two-edged sword on the part of Tesla. In the short run, it is pushing forward a customer rush demand as buyers throng to embrace incentives. However, in the future, the expiration is projected to have a major effect of slowing down the demand, leaving the automakers in a desperate bid to support the demand in 2025.

According to industry analysts, the U.S. EV market will be hit by a 12- to 18-month slowdown or worse since future buyers who have missed the tax credit will be reluctant to buy or switch to lower-priced models.

Tesla’s Inventory Problem

Although Tesla is the leader in EVs, it still faces challenges that other automakers also face. Global revenues are down by approximately 13% on a year-to-date basis, and though the quarter is so far turning out to be better, largely due to drawn-forward demand, the company continues to face year-over-year decline.

Making things more difficult, Tesla currently has is stacked with over 50,000 unsold cars. The figure suggests that there is seriousness in unconventional efforts, such as used car leases. By accessing a beautiful pool of cost-sensitive customers, Tesla will not only manage to conquer its stocks but also enhance deliveries in America.